Financial technology has changed the way we manage money. From mobile payments to online banking, it’s all been a revolution. Many investors are looking to profit from the growth of these industries. Fintech investing may seem complicated, but beginners can easily build a strong foundation with the right strategy. Fintech Landscape: Understanding it Fintech is a broad …

In the past, sending money across borders was time-consuming, expensive, and cumbersome. If you, as a business owner, needed to pay a supplier abroad or transfer money to a family member abroad, you had to wait days and pay high fees. But with the development of financial technology (fintech), everything is changing rapidly. Fintech companies …

Cryptocurrency and financial technology (FinTech) are two of the most disruptive forces in modern-day finance. Both have challenged traditional systems, pushing the boundaries of what is possible in terms of efficiency, accessibility, and innovation. Now, their convergence has ushered in a new era of decentralized finance (DeFi), a financial movement that has the potential to …

In today’s digital economy, financial technology (Fintech) is changing the way people manage money, get credit, invest, and manage other everyday financial matters. Peer-to-peer payment systems, digital wallets, and online investment websites are making it easier than ever for people to share more personal and financial information. These new technologies make everything easier and faster, …

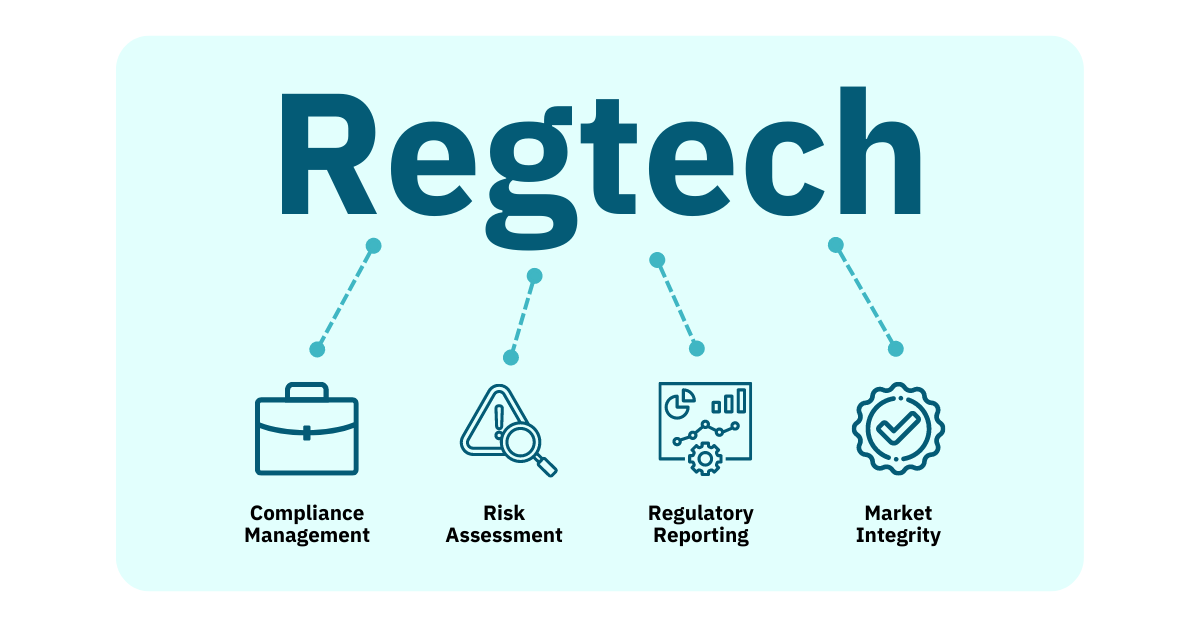

In today’s rapidly changing digital financial world, regulatory technology (RegTech) has become a key tool to help fintech companies better meet regulatory requirements. To comply with financial regulations, RegTech uses technology (primarily software) to simplify and further automate processes. As the financial sector becomes more digital and complex, regulatory compliance becomes increasingly difficult. This is …

In recent years, peer-to-peer lending has become a more popular alternative to the traditional lending system. This new way of lending directly between individuals via online websites is changing the way people think about money. P2P lending offers consumers and investors a new way to get the money they need without going through a bank …

Automating business finance processes that have traditionally been manual or time-consuming with AI could save businesses significant effort and hassle, including document verification, data collection/entry, and more. Accessing AI tools can help free up time for more strategic client planning and save you time in general. But before making changes to your practice using these …

With fintech developing rapidly, people are interested in the similarities and differences between mobile wallets and traditional banks. As mobile apps become more popular, many users are starting to compare their pros and cons with the reliability and services of traditional banks. This comparison helps people make the best choice for their daily financial needs …

Neobanks put emphasis on ease and convenience. For example, they typically provide debit cards without minimum balance requirements and enable international payments without currency conversion hassles. Neobanks provide other key advantages, including quick account setup, real-time notifications, and budgeting tools. And by taking advantage of AI technologies like platform integrations and analysis techniques, they can …