Technology has become a central part of our lives, including the lives of our children. From devices that help them stay connected to gadgets designed for learning and entertainment, there’s an overwhelming array of options for parents. But how can you ensure that your child’s tech is both smart and safe? Choosing the right personal …

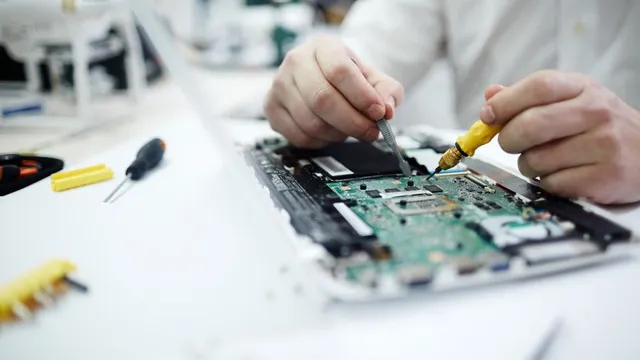

Refurbished appliances have become increasingly popular over the past decade as consumers have become more environmentally conscious and economically conscious. These products are returned to the manufacturer or certified supplier, inspected, repaired, and then resold at a discount. Refurbished appliances are inspected before they are sold, unlike “as is” products. Refurbished appliances perform like new …

Technology has effortlessly woven into the way we live, making chores more efficient while keeping us connected and even enhancing our enjoyment. From communications devices to entertainment hubs our tech devices that we use daily are now multi-faceted partners. This article will explore the important technology gadgets that do more than simplify our routines, but also enrich …

The circular economy is gaining popularity, especially in the technology sector. The circular economy extends the life cycle of products and reduces waste, a radical departure from the linear “take, make, throw away” model. It involves developing technologies that are repairable, reusable,, and recyclable. The circular economy aims to close loops and maximize the use …

Your gadgets should help make life simpler, more enjoyable, and more convenient – not the other way around! Don’t take chances with what could potentially be lifesaving technology! These everyday essentials will enhance your quality of life. Prioritize devices with intuitive user interfaces and minimal learning curves to save yourself time in understanding how they …

Computers have become indispensable in our personal and professional lives today, as we live in a digital environment. From laptops and desktops to servers and data centers, these devices consume a lot of energy on a daily basis. With rising energy prices and increasingly urgent environmental issues, energy-efficient computing has become an important goal. Reducing …

Traveling is among life’s most satisfying pleasures. When you’re planning an escape for a weekend or on an adventure across the globe using the appropriate tech tools can make your trip pleasant, smoother and enjoyable. Travel has changed with the advancement of technology, giving us solutions to common problems as well as keep us connected and let …

One of the biggest environmental issues we face today is plastic pollution. Millions of tons of plastic waste end up in landfills and oceans every year. This makes it more important than ever to find eco-friendly alternatives. While plastic is convenient, durable, and cheap, it has a huge impact on the environment in the long …

Smartphones are now an essential part of our daily lives, serving as our communication lifeline, productivity tool, and sometimes even as an extension of our identities. However, as convenient and sophisticated as they are, smartphones are not immune to security risks. From malware to phishing attacks, the stakes of leaving your smartphone vulnerable are higher …

In today’s digital economy, financial technology (Fintech) is changing the way people manage money, get credit, invest, and manage other everyday financial matters. Peer-to-peer payment systems, digital wallets, and online investment websites are making it easier than ever for people to share more personal and financial information. These new technologies make everything easier and faster, …